Separation Pay in the Philippines

Okay, so many people have been PM’ing me re: how much is their Separation Pay for the 4Rs of Termination — Retrenchment, Redundancy and Retirement. So once and for all, this is the encompassing entry on how much an employer should pay you if they are terminating your employment.

To make it simple, I have made an Excel Calculator for you guys. Simply download the Excel, Access via the Desktop so you can input the data, and get an estimate on how much you should get.

Download it HERE for FREE: Final Separation and Retirement Pay Calculator (TinainManila.com)

But if you still want to get more information as to why the numbers are like that, we will go through them one by one so you won’t feel cheated by your bosses. Please feel free to jump to the part that’s relevant for you.

Here are Top 12 Questions on Separation Pay Answered:

- How much Separation Pay do I get if I voluntarily resign?

- How much Separation Pay do I get if pinilit akong magresign?

- How much Separation Pay do I get if I am in “Floating Status?”

- How much Separation Pay do I get if I Retire?

- How much Separation Pay do I get if I was Retrenched?

- How much Separation Pay do I get if I was made Redundant?

- How much Separation Pay do I get if I was a Bad Boy in my Company and I was Fired for Just Causes:

- How much Separation Pay do I get if my contract ended as a Contractual Employee?

- How much Separation Pay do I get if my contract ended as a Project-Based Employee?

- How much Separation Pay do I get if my contract ended as a Freelancer?

- How Much Separation Pay do I Get if My Contract Ended as a Probationary Employee?

- How Much Separation Pay do I Get if I Complain to DOLE/Tulfo?

Question 1: How much Separation Pay do I get if I voluntarily resign?

Unless your boss is super nice, you get ZERO separation pay if the resignation was voluntary.

Even if you worked for 25 years, if you resign, your employer is NOT obliged to give you any separation pay UNLESS there was a prior agreement that they would give you one.

This is the law — No separation pay if you signed voluntarily. Why? It is not your employer’s fault on why you want to let go of the job you have because of (Insert reasons here). So why should they pay you any separation pay?

Followup: But what if I resigned at the heat of the moment. But I want to retract the resignation. Pwede ba?

Once you voluntarily resign — complete with WRITTEN resignation letter — it’s company discretion to accept your retraction or not. There is a 30-day notice period for turnover. However, if the company decides to forgo the notice period, they can accept your resignation and have you end your employment before the expiration of the 30 day notice.

Here’s more info about Resignations, but it a nutshell:

“It was explained by the Supreme Court in Hechanova vs. Matorre (G.R. No. 198261, 16 October 2013) that the 30-day notice requirement for an employee’s resignation is for the benefit of the employer in order to afford the him enough time to hire another employee if needed and to see to it that there is proper turn-over of the tasks which the resigning employee may be handling.

Since the 30-day notice is for the employer’s benefit, he may waive such period. Thus, in Paredes vs. Feed the Children Philippines, Inc. (G.R. No. 184397, 9 September 2015), the Supreme Court elucidated that the rule requiring an employee to stay or complete the 30-day period prior to the effectivity of his resignation becomes discretionary on the part of management as an employee who intends to resign may be allowed a shorter period before his resignation becomes effective. Hence, as part of management prerogative, an employer has the right to move the effectivity date to an earlier date.

Take heed that if an employee does not give the 30-day notice, he can be held liable for damages to the employer. An aggrieved employer may file a civil case for damages and breach of contractual obligation with the regular courts.”

A resignation letter — once accepted — is valid and final. An employee cannot blame the employer for accepting his/her resignation letter that was willingly given just because it was made “on the heat of the moment.”

If the employer accepts it, walang bawian na yan. May this be a lesson to you NOT to resign when you’re mad. Just remember:

Question 2: How much Separation Pay do I get if pinilit akong magresign?

Same as Answer 1, Unless you can prove that the resignation was truly forced — for example, your boss had a gun pointed to your head to get you to resign, you still get ZERO separation pay if you resigned.

We are all working adults who can think. Please take responsibility for your actions. Once you sign that resignation letter and handed it to your boss, it will be very hard to prove that you were forced to write it. The only lusot is that they forged your signature, which is unlikely. Once you sign that piece of paper, that’s it.

No separation pay if you resigned. And the resignation was accepted.

Question 3: How much Separation Pay do I get if I am in Floating Status?

One again, the answer is a ZERO. Because you’re still employed, albeit on “Floating Status.”

Under Article 301 of the Labor Code it is provided as follows:

ART. 301. When employment not deemed terminated. — The bonafide suspension of the operation of a business or undertaking for a period not exceeding six months, or the fulfillment by the employee of a military or civic duty shall not terminate employment.

In all such cases, the employer shall reinstate the employee to his former position without loss of seniority rights if he indicates his desire to resume his work not later than one month from the resumption of operations of his employer or from his relief from the military or civic duty. If there’s no work to be returned after max of 6 months floating status, the separation pay shall be equivalent to one (1) month pay or at least one-half (1/2) month pay for every year of service, whichever is higher. A fraction of at least six (6) months shall be considered one (1) whole year.

SHOULD YOU GET PAID WHILE ON FLOATING STATUS?

Sad truth is the company has ZERO obligation to pay you basic salary under the rule no work, no pay. See Section 2. Labor Advisory No. 1, Series of 2020:

Although there are companies who give basic pay to their employees who are on floating status, they are rare. If you’re in one, stay there. I had a friend who was earning while he was sitting at home waiting to be called and report back to work as soon as there’s an opening. Because he was placed on floating status.

WHAT HAPPENS WHEN 6 MONTHS HAVE LAPSED?

Your employer will pay you separation and the separation pay due to you based on your last day on the job. Unless of course they’re able to find a new campaign for you. Provided that the campaign will accept you and that you’re a fit for the opening.

IMPORTANT: Please note that companies that employed you under direct hire, 6 months is the maximum number of months to float an employee. For manpower agencies, it’s 3 months IF the reason is a lack of other clients to reassign you.

Butch Espinosa helps clarify by stating, “Service providers like contractors and subcontractors are also employers and the 6 months floating status applies also to their employees.

The usual misinterpretation even by some lawyers are based on DO 174 particularly Paragraph 3 of Section 13. To wit:

“Where the termination result from the expiration of the Service Agreement, or from the completion of the phase of the job or work for which the employee is engaged, the latter may opt to wait for re-employment within three (3) months to resign and transfer to another contractor-employer. Failure of the contractor to provide new employment for the employee shall entitle the latter to payment of separation benefits as may be provided by law or the Service Agreement, whichever is higher, without prejudice to his/her entitlement to completion bonuses or other emoluments, including retirement benefits whenever applicable. The mere expiration of the Service Agreement shall not be deemed as a termination of employment of the contractor’s/subcontractor’s employees who are regular employees of the latter.”

However, perusal of the said provisions refers to instances wherein the termination was due to expiration of the service agreement or from the completion of the phase of the job or work for which the employee is engaged. Not in instances like when there is sudden discontinuation of work due to lack of materials, insufficiency of work or quarantine imposed by the government due to COVID-19. In these instances, it is my humble opinion that the 6 months floating status still applies.”

Please note that if the manpower agency tried to assign you to another work and you refused, they can legitimately float you, or even force you to take on the work. If you refuse, they can follow due process to terminate you for insubordination. In that case, you get zero because the agency has done their part in assigning you work, and yet you refused. The law is then on the manpower agencies’ side because they tried to find you work. it’s just you who refuse to work.

Question 4: How much Separation Pay do I get if I am Retired?

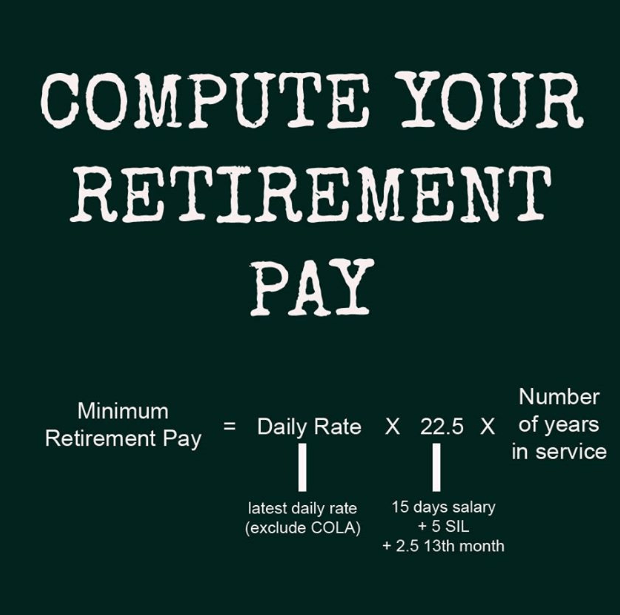

Source: Atty. Pol Sangalang, Updates on Labor Law and Jurisprudence

Source: Atty. Pol Sangalang, Updates on Labor Law and Jurisprudence

Retirement Pay in the Philippines is 22.5 x Years of Service x Monthly Salary

Retirement Pay only counts the staff’s current year of salary in computation. In short, it does not matter how much was your salary when you first started. What matters is how much you earn today when you are retired:

To compute for the retirement pay, the information we need are the following:

- Monthly Salary at the Time of Retirement:

- Years of Service:

The law says, “In the absence of a retirement plan… an employee upon reaching an age of 60 years or more, but not beyond 65 years which is hereby declared the compulsory retirement age, who has serviced at least 5 years in the said establishment, may retire… The retirement pay is equivalent to at least 1/2 month salary for every year of service, a fraction of at least 6 months being considered as one whole year.

This means if you served with increments of 1 month to 5 months, you round down. And if it’s increment of 6 months and up, you round up.

This means that if you’re in the company for 10 years and 2 months, that’s counted as 10 years. And if it’s 10 years and 6 months, that’s already counted as 11 years. Get it?

The longer you stay in a company, the higher the Retirement Pay. Since the factor is 22.5 days for every year of service, a Retired Staff gets almost a 14th month pay for every year of service. Not bad just for sticking by one employer.

This is the jurisprudence on why it’s 22.5 days:

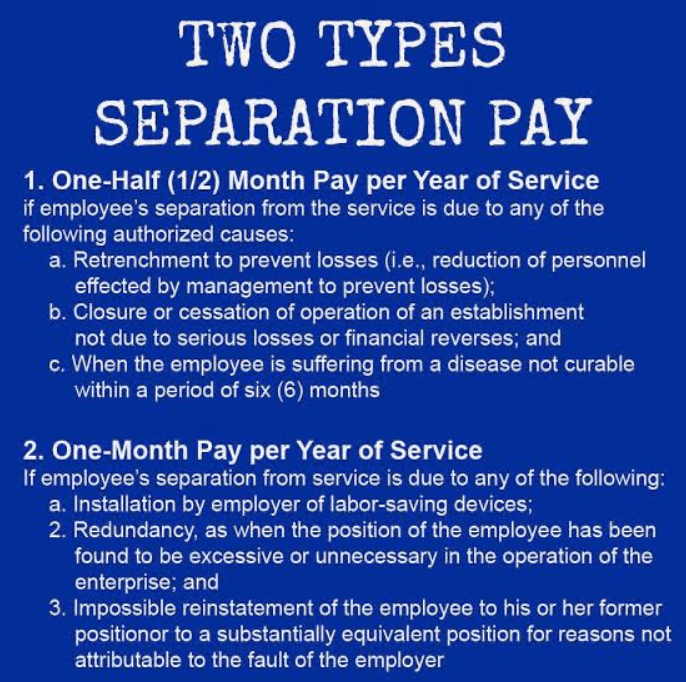

Question 5: How much Separation Pay do I get if I am Retrenched?

It’s very clear in Article 298, Authorized Causes of Termination —- For termination due to retrenchment or closure/cessation of operation its one month pay or 1/2 month pay for every year of service whichever is higher. Para hindi magulo, retrenchment is defined by the Supreme Court as follows:

If you were retrenched to prevent losses, because an establishment closed NOT due to serious losses, or when you are suffering from a disease that’s incurable within 6 months, you get 1/2 pay per year of service:

Compliance with the Legal Procedure for Retrenchment

In order to legally retrench employees, the following must be followed:

(1) Retrenchment is undertaken to prevent losses, which are not merely de minimis, but substantial, serious, actual, and real, or if only expected, are reasonably imminent as perceived objectively and in good faith by the employer;

(2) The employer serves written notices both to the employees and the DOLE at least one month prior to the intended date of retrenchment;

(3) The employer pays the retrenched employees separation pay equivalent to one month pay or at least ½ month pay for every year of service, whichever is higher;

(4) The employer must use fair and reasonable criteria in ascertaining who would be dismissed and retained among the employees; and

(5) The retrenchment must be undertaken in good faith [Ariola v. Philex Mining Corporation (G.R. No. 147756, 09 August 2005)].

Separation pay may NOT be as big as you think.

So Sir Richard DeDios gave this calculation of the severance of a 22-month tenured employee:

“Ang 22 months is equivalent to 2 years tenure by virtue of the provision that a fraction of 6 months or more is considered 1 year.

Then said employee is only entitled to 1 month separation pay (1/2 per year of service x 2 years). The minimum 1 month applies to those with less than 1.5 years of tenure since they will only be entitled to 1/2 month pay if the entitlement is 1/2 month per year of service”

In short, for Retrenchment:

1 mo – 2 yrs 5 mos = 1 month pay

2 yrs 6 mos – 3 yrs 5 mos = 1.5 months pay

3 yrs 6 mos – 4 yrs 5 mos = 2 months pay

4 yrs 6 mos – 5 yrs 5 mos = 2.5 months pay

Thank you Sir Richard! ❤️

NOTE: Regarding the disease that’s incurable for 6 months, the fine print is that the employer may terminate employment on ground of disease only upon the issuance of a certification by a competent public health authority that the disease is of such nature or at such stage that it cannot be cured within a period of six months even with proper medical treatment. So no, COVID-19 does not count for you to get Separation pay.

Question 6: How much Separation Pay do I get if I was Made Redundant?

This is how we define Redundancy in the Philippines:

Separation Pay is one month pay per year of service, whichever is higher. So you multiply your years of tenure by the monthly basic pay, and that’s it. That’s your separation pay:

In short, for Redundancy, you get paid:

- 1 mo – 1 yrs 5 mos = 1 month pay

- 1 year 6 mo to 2 yrs 5 mos = 2 months pay

- 2 yrs 6 mos – 3 yrs 5 mos = 3 months pay

- 3 yrs 6 mos – 4 yrs 5 mos = 4 months pay

- 4 yrs 6 mos – 5 yrs 5 mos = 5 months pay

Easy ain’t it?

Question 7: How much Separation Pay do I get if I was a Bad Boy in my Company and I was Fired for Just Causes:

Once again, if you have been a bad boy and got fired from your employer for Just Causes, you get:

These are the reasons why you can get fired for Just Causes and get ZERO separation pay:

- Serious misconduct;

- Willful disobedience;

- Gross and habitual neglect of duty;

- Fraud or breach of trust;

- Commission of a crime or offense against the employer, his family or representative;

- Other similar causes

Specifically, according to DOLE Department Order No. 147, Series of 2015:

The Labor Law is in the Employer’s side on this. Even if it’s a pandemic, even if you’ve resigned, and even if you’ve gone AWOL, your employer can still terminate you following DUE PROCESS if you have committed a terminable offense under the labor code. See DOLE Department Order No. 147, Series of 2015:

The Labor Law is in the Employer’s side on this. Even if it’s a pandemic, even if you’ve resigned, and even if you’ve gone AWOL, your employer can still terminate you following DUE PROCESS if you have committed a terminable offense under the labor code. See DOLE Department Order No. 147, Series of 2015:

Question 8: How Much Separation Pay do I Get if My Contract Ended as a Contractual Employee?

Let us first define what Contractual Employee means as below:

As to how much is the separation pay a contractual employee gets, the answer is once again ZERO. As to WHY, this is because a contractual employee is governed by the contract he signed when he started his employment. Upon signing the contract, the employee recognizes that he is only hired by the company for a specific predetermined time, with a START DATE and an END DATE and hence, once the task is done, he will no longer be employed by the company.

Image Source: NorthLuzonPolitics.com

This is the reason why so many companies hire Contractual Employees from manpower agencies. There is NO employer and employee relationship between the Principal and the Contractor. So in the end, the Manpower Agency is the employer of the contractor, and NOT the principal/customer themselves. If someone will be regularized, he is a regular employee of that agency, and not the company.

This is supported by Section 10, Department Order No. 18, Series of 2020, Rules Implementing Articles 106 to 109 of the Labor Code As Amended:

If this sounds unfair, do not get into a contractual employment.

If this sounds unfair, do not get into a contractual employment.

Question 9: How Much Separation Pay do I Get if My Contract Ended as a Project-Based Employee?

But of course, employers still have to be careful because there is this fine print of when Project-Based Employees can get Separation Pay:

But of course, employers still have to be careful because there is this fine print of when Project-Based Employees can get Separation Pay:

Question 10: How Much Separation Pay do I Get if My Contract Ended as a Freelance Employee?

Question 10: How Much Separation Pay do I Get if My Contract Ended as a Freelance Employee?

Former senator Paolo Benigno “Bam” Aquino defines a freelancer as “any person hired or retained as an independent contractor by a hiring party, to provide service in exchange for compensation.” It’s become more common nowadays to work as a freelancer as more people become unemployed.

However, the problem with freelancers is that there is no formal employer-employee relationship between him and the client. Thus, Labor Law does not dictate the client to pay any separation pay if in case the client does not hire the freelancer for the next job.

According to the Philippine Labor Code, an ‘employee-employer’ relationship must first be strongly established in order for employees to get compensation. Since the company is a client/customer, and the business is hiring the freelancer for a specific job, there is no employer-employee relationship and hence, no separation pay if in case you don’t get called back for another project. The Philippines still require the employer-employee relationship to be conventionally done inside a physical building, institution or existing organizational structure to be recognized. This is not the case for freelancers, where you only have a contract. Since it’s an employer-employee relationship is hard to prove, it’s almost impossible to ask the company to pay you separation pay.

The answer is ZERO — If you want Separation Pay, don’t go for the gig economy and enter the workforce formally and work for an employer exclusively.

This is the reason why your Grab Driver, Angkas Driver, Freelance Photojournalist don’t get a lot of benefits. If you freelance, that’s on you. You control your time and if you don’t want to do the gig anymore, everyone part ways with nary a complaint.

Question 11: How Much Separation Pay do I Get if My Contract Ended as a Probationary Employee?

Technically, a Probationary Employee when terminated is not entitled to Separation Pay if a) He was terminated for Just Causes (Meaning to say, ikaw ang may mali), or

b) If the employee failed to satisfactorily meet and comply with the reasonable standards, conditions and requirements made known to him at the time of his engagement.

Pag bagsak ka sa evaluation, final pay lang. So an employer needs to ensure he has the written evaluation to show that the employee has failed the reasonable requirements for regularization so that the company does not need to give final pay.

However, you will get Separation Pay if the reason of termination was Retrenchment or Redundancy

Article 283 of the Labor Code states that:

Art. 283. Closure of establishment and reduction of personnel. — The employer may also terminate the employment of any employee due to the installation of labor saving devices, redundancy, retrenchment to prevent losses or the closing or cessation of operation of the establishment or undertaking unless the closing is for the purpose of circumventing the provisions of this Title, by serving a written notice on the workers and the Ministry of Labor and Employment at least one (1) month before the intended date thereof. In case of termination due to the installation of labor saving devices or redundancy, the worker affected thereby shall be entitled to a separation pay equivalent to at least his one (1) month pay or to at least one (1) month pay for every year of service, whichever is higher. In case of retrenchment to prevent losses and in cases of closures or cessation of operations of establishment or under taking not due to serious business losses or financial reverses, the separation pay shall be equivalent to one (1) month pay or at least one-half (1/2) month pay for every year of service, whichever is higher. A fraction of at least six (6) months shall be considered one (1) whole year.

The Labor Code indicates that all workers — Probationary or Regular Employees — are entitled to separation pay if they were terminated under the following conditions:

Separation pay is 1 MONTH OF PAY because minimum amount of separation pay is 1 month since probationary employees have not yet reached a year of service.

Question 12: How Much Separation Pay do I Complained to DOLE/Tulfo?

Quick and dirty answer — Only what is due you by law.

DOLE/Tulfo/Your Mother CANNOT compel the company to pay you a single cent more than what is legally due you by law. You may shout, scream, complain and cry but if you are in the wrong, you still do not get anything more than what is due you.

Again, only run to Tulfo and DOLE if your rights truly are abused. As mentioned before too, it’s not good to burn bridges with a former employer unless you don’t plan to work elsewhere anymore. Most employer know if they are following the law or not. Most will be amenable to a settlement or negotiation if the employee was just patient enough to communicate their requests in a nice and respectful way.

However, once you run to DOLE/Tulfo, that’s it. All bets are off. Boksingan na talaga!

So I would suggest that you run to Tulfo or DOLE only as a last resort.

If there is an issue, talk to the company FIRST — Go through your line manager, then HR, and if needed, the big boss. Try to settle the issue there before making mountains out of molehills.

Secondly, double check that you’re on the RIGHT — Meaning, you’re correct and there was a clear abuse by your employer to you. A lot of employees complain because they are pissed off, only to find out that they are in the wrong, and doon sila papagalitan ng DOLE sa SENA meeting.

Three, make sure that the amount you’re complaining about is still SUBSTANTIAL — I can understand if you’re complaining for your separation pay after 25 years of service. Even if you’re earning minimum at Php 14,000, that’s still a lot of money at Php 175,000.

Breakdown: Php 14,000 x 0.5 month pay per year of service x 25 years = Php 175,000.

But if you’re for example only employed at the company for less than 2 months and the ECQ hit, and then you complain to DOLE immediately? This trigger happy response will make you unhire-able, a pariah to most other companies. Because who would want an employee who immediately runs to DOLE for every perceived slight he has?

Look, I’m not saying you should not.

There are people who have come to me for advice and I have explicitly guided them to go to DOLE if they could not convince their employer to pay them what’s right. However, this should be a last resort, if your employer is a total A-hole who don’t want to give you their due.

Plus, if You Are Wrong, Going to DOLE/Tulfo will NOT Get You What You Want.

It will only leave a bad taste in your previous employer’s mouth. What do you think they will do if a future employer calls them up for a background check?

As they say, don’t burn your bridges. There’s no obvious way of burning bridges than DOLE-ing an employer.

DOLE and Tulfo is there to protect your interest IF there is true abuse. Just make sure that there is before running to them. Because if the company is truly in the right and not in the wrong, and you did complain against them because nagtampo ka, sayang lang ang oras mo and you had burned a bridge that can potentially help you in the long run, especially when you find new work.

If you like my posts and would like to subscribe to TinainManila.com, you can enter your email below. Thanks and looking forward to seeing you visit more!

Well explained. You are truly a blessing for non HR’s like us. Thank you so much for your effort. Keep safe Ms. Tina. God bless you and your family.

Thank you so much for leaving a note! Hope people will read this and remain chill. So most won’t think na dinadaya sila ng employers nila kahit hindi naman. Appreciate your comment!

Wow…Detailed explanation with good description. Interesting to read lalo na ang mga mahilig magpunta kay Tulfo haha..Thanks a lot

Thank you so much for reading and commenting Jasmin!

Hi Ms. Tina,

Your blogs are very interesting. I would like to ask your opinion regarding my experience. I am dismissed because I didn’t complete the Probationary period because of maternity leave. No record of poor performance, no termination letter, just the sole reason of kulang sa months pero dahil yan sa nanganak ako. Sa chat lang ako tinerminate. Am I illegally terminated? And if im illegally dismissed, how much separation pay can I negotiate instead of filing a case in NLRC?

Already answered in chat.

Long story short, for 3 years, it’s 1.5 months separation pay. However from our conversation, I learned you came in as a teacher with a probable 3 year contract arrangement.

To be given tenure, you need to fulfill three requirements as per contract including the approval of an officer of the school. This you did not get yet. So my feeling is that the contract is merely an end of contract and the school is not obliged to renew it because they probably felt you were not a good fit to the company.

You may double check but your case is not as clear cut since you’re working in the education sector and a project based or contractual arrangement. End of contract is just that…… end of contract. And hence, most likely no separation pay.

Thanks for the article, can you please let me know if the following is outdated or incorrect? It’s what I’ve used as a reference for awhile:

https://www.tripleiconsulting.com/tax-blog/separation-pay/

The article is not false but too many words to drive a few simple points as follows:

– If a person resigned, zero sep pay

– If a person was terminated for just causes, zero sep pay

– If a person was terminated for authorized causes, WITH sep pay but 1/2 month pay or one month pay depending on reason of termination

Best to just be straight to the point.

Hi mam Tina,

Avid reader nyo po ako.

Pahelp po sana mam:

We have 3 employees who went on Leave since the start of ECQ last April. Wala po silang nilagay sa leave form if when sila babalik. Malapit na pong mag lapse ang 6months mam and we texted them na bumalik na sa work pero iba sa kanila ayaw pa rin muna then others would say next year na. Ano po ang gagawin ni employer po? Thank you

Ask them to report to work formally by issuing a Return to Work Order

https://tinainmanila.com/2020/09/15/hr-talk-what-to-do-if-the-staff-refuses-to-report-to-work/

If they don’t report, FOLLOW DUE PROCESS to terminate

How much separation pay will you get if you got retrenched as a contractual employee?

Let us say third time nakong pumirma sa contract. First one is 6 months, second one is 2 and a half years and 3rd one is 2 years.

Nasa 3rd one nako and di pa tapos yung contract but ireretrench nako. Pano calculation ng separation pay ko nun?

How much time left is there on the last contract? What’s your job and why are your contractual periods different per time?

I have 6 months left based on my current contract which is the third.

I am an IT Engineer. Contractual periods are different based on their estimated needs of their project but it is continuously extended from the first one.

I would like to know if my separation pay will be based on 5 years or just 2 years (because of my current contract)

Separation pay will be based on your 2 years — actually, what’s left on your 6 months contract.

The rest of the contracts were cleanly done. These are project based. End of contracts don’t have separation pay.

Oh ok so in my case if I have a salary of 25,000 then I will just get 25,000 as a separation pay because I have 6 months left in my contract?

But if my contract is 3 years then they decided to terminate me via redundancy when I still have 2 years left in my contract then I will have 50,000 as separation pay.

Is my understanding correct?

You’re project based kasi e.

If you’re a regular employee with a salary of Php 25,000, and they retrench you with a 30-day notice period, your separation pay should only be 1 month of pay. Computation breakdown is 1/2 month per year of service.

The 30 day notice period may be paid if you work during that notice period. If not, that’s unpaid.

Hope this helps!

I guess that is the case for retrenchment. But what about redundancy? I assume that it is almost the same as retrenchment but w/o the need of 30 days notice. Therefore:

– I will just get 25,000 pesos separation pay if I have 6 months left in my contract

– But if I have 2 years left in my contract then I will get 50,000 pesos as separation pay.

I hope my understanding is precise

No, if retrenchment, you get ₱25,000 as separation pay with a one month notice.

It is retrenchment if they are losing money. A redundancy if they overhired you which does not seem to be the case.

Both needs 30 day notice period.

So there is no ₱50,000. Just ₱25,000 for a tenure of 2 years 5 months or less.

I think my current case will be overhiring so it is redundancy.

Interesting, so for contractual.. The computation of separation pay is per 2 years and 5 months. I have been searching this knowledge for awhile.

Depends – can’t really determine unless your contract is read and management is consulted. All I’m saying is, if retrenchment, it’s 1/2 month of pay per year of service. For redundancy, it’s 1 month per year. Both minimum one month of pay.

Third time nakong pumirma on the same company. Parang extend lang ng extend ng contract.

Please ask your HR how much separatoon pay they plan to follow.

Hello po na Retrenched po ako sa company pintrabahuan ko serving for 6years , they promised to pay may every end of the month for 12 months, pero hindi po sila nagbabayad pwede ko na po ba sila ipa DOLE? they keep on reasoning on us na wala daw po pera company ngaun.

What do you mean pay you at the end of every month for 12 months? This does not make sense…..

Are you saying they have agreed to pay you 3 months of wages, since this is your separation pay after 6 years of service. They wanted to pay you in installment over a 12x period. Do you have this agreement in paper?

Hi Tina, your blog is very easy to understnd yet very informative and helpful. In the absence of a retirement policy, should my company pay for VL and SL upon retirement? Ano nakalagay sa labor code?

Thanks Peter.

The Retirement policy follows the Labor Code. There is a set mandated age when one staff should be retired, and HOW MUCH his Retirement Pay will be.

The VL and SL — especially if more than the 5-day Mandated Service Incentive Leave — follows company policy. The company sets when it will be rewarded, how it can be applied for, and when is it not given. In other words, Management prerogative. This rules it retirement or otherwise.

Thank you very much

VL and SL beyond the 5 day Service Incentive Leave is management prerogative.

Retirement policy: 65 years old is the mandated by law age. In absence of retirement policy, the law follows.

https://tinainmanila.com/2020/07/04/hr-talk-why-do-we-need-to-pick-our-employers-well-and-how-to-compute-for-retirement-and-separation-pay/

Hi Mam Tina, thank you sa napakainformative na blog nyo and sana mapansin nyo ako. Im was employed as a manager sa isang lending company before i resigned last March 2020. The separation pay was clearly stated in our company manual. The problem is the company still needed me to attend court hearing as a witness which could take years for me na matapos. The company offer me that they pay half of my sep pay then the remaining will be after matapos lahat ng court hearings ko. Is that possible? Meron b nakalagay sa labor code? Thank you in advance.

Company is obliged to pay ENTIRE separation pay. Up to the staff to agree if ok lang half at exit and half at end of hearings. If I were him, I would not agree. Hearings take years.

You can negotiate they pay you X amount of money every time you appear.

We are an educational service company, we are only two regular employees and the rest are contractual or labeled as consultant. Then since March last yr, my old boss sold the business to a new owner (director) but the owner of the trade name is still the old boss. That said, I was in between them, my old boss is not communicating nor giving a notice letter of what will happen to me as employee in a inter transfer of Company. Of course the new management has no obligations to me, but he said he will still take me as his employee. So my new boss told me to resign, but I felt there’s something wrong if I it. But I was really wondering, because my old boss is not fond of me as his employee, but still worked for him for about 2 yrs (didn’t add my work to the new one). I’m just anxious and weary if he has the guts to write to terminate me with “just reason” and not the authorized reasons. Where in fact, if he has that kind of feelings about me, He won’t let me stay that long working there. Do I have the right to appeal on that kind of treatment of the employer? just to save himself from paying the separation pay?? Thank you so much and great Blog 👏🏻

Are you regular or consultant?

Thank you for sharing your excel calculator. I was looking for one from DOLE’s website but didn’t find any. With the help of your calculator, I can cross-check my own computation. I came across your blog last year when I was looking into temporary floating. Your blog entries are clearly written and easy to understand. So thank you for creating this blog 🙂

Hi, we have read several of your blog entries on labor matters and learned a lot. Do you have recommendations for labor lawyers who can craft a position paper for my husband’s NLRC against his employer? Thank you very much.